Climate Disclosure: Key Reporting Standards You Need to Know

Organisations are backing up traditional financial reports with information concerning their sustainability performance. Sometimes by choice, but more often than not it’s due to internal or external pressure.

Within the realm of non-financial reporting, growing attention is being posed to corporate disclosure of climate-related information.

By that, we mean:

The publication of information concerning the business impacts on climate and vice versa.

- European Commission

Releasing information about one organisation’s impacts on climate is already part of wider ESG reporting frameworks. Such disclosure is requested within the following non-financial reporting standards:

- GRI

- SASB

- SDGs

- UNGC

However, in this article, we dedicate specific attention to reporting standards that focus on climate action.

The ecosystem of climate-related disclosures

This article explores the following climate-related disclosure standards:

- CDP

- TCFD

- TNFD

- SEC

CDP

CDP has developed a global disclosure system for organisations, cities and countries to disclose their impacts on:

- Climate change;

- Water security;

- Forests.

The wide collection of environmental data managed by CDP is used by investors to:

- Make informed decisions;

- Drive capital towards more sustainable companies.

Disclosing entities submit a questionnaire based on which they are then assigned a score ranging from A to F.

Score A – Leadership

A-Score companies fully disclose their action on climate change, deforestation and water management. These companies lead the way and set in place best practices. On top of that, A-listed entities:

- Set Science-Based Targets

- Create a climate transition plan

- Develop water management strategies

- Report on the impacts generated on forests

Score B – Management

The company is managing its impacts on the environment. However, there is still a gap that separates it from leaders in action against climate change, deforestation and water security.

Score C – Awareness

The company is aware of the mutual relationship between its operations and environmental impacts. The C or C- Score is based on the extent to which the organisation evaluates how sustainability issues affect the business.

Score D – Disclosure

Every question in the CDP questionnaire scores for disclosure. Yet, there is space for improvement in terms of the actions undertaken to tackle environmental issues. Hence, companies that score a D or D- are just at the beginning of their climate journey.

Score F – Failure

F Scores are attributed to companies that fail to report according to CDP.

Entities interested in disclosing according to CDP can submit the questionnaire from April to August. The final scores are released before the end of the year, in December.

2022 results just got published on the CDP website, where:

- 283 companies entered the Climate Change A List;

- 25 companies made it to the Forests A List;

- 103 companies achieved A-score for Water Management.

To get ready for submission, you can read the guidelines published by CDP here.

Finally, we can expect CDP to implement a few changes by 2025:

- The CDP questionnaire will probably expand beyond climate, forests and water. The goal is to paint a more accurate picture of the status of the planetary boundaries. This will require data on biodiversity, resilience, waste and food.

- CDP claimed it will keep its focus on environmental impacts. Regardless, we can expect future developments aimed to integrate social and governance metrics in the assessment to some extent.

Hence, if you want to learn more about how you can use CDP as a tool to report on your overall ESG strategy, read this article.

TCFD

Task Force on Climate-related Financial Disclosure

The TCFD is an initiative created by the Financial Stability Board to improve transparency on climate-related financial information.

The ultimate goal of the TCFD is to provide clear and quality information to correctly price climate-related risks and opportunities.

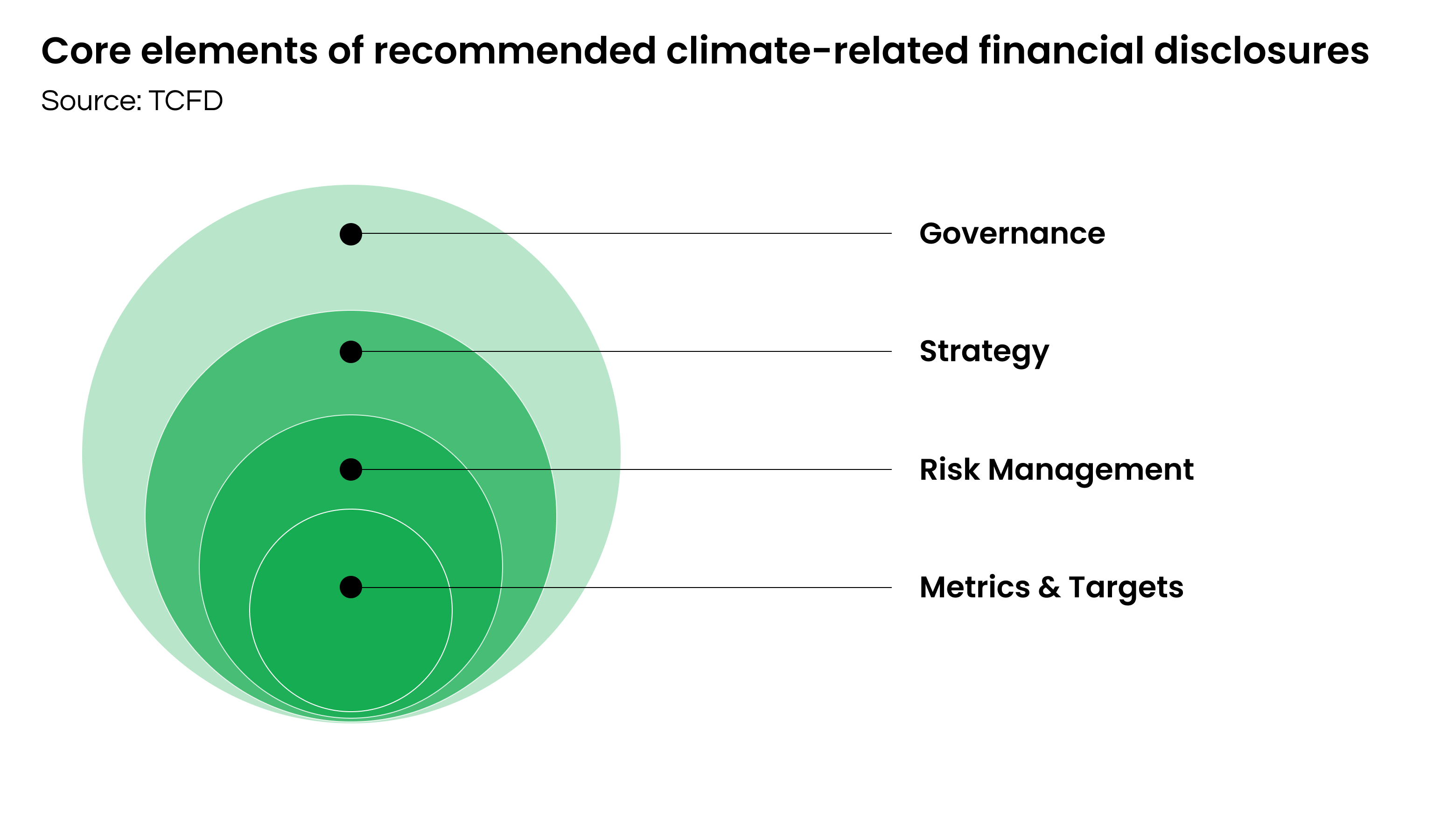

Reporting organisations are recommended to report on four key areas:

- Governance – How is management overseeing and assessing climate-related risks and opportunities?

- Strategy – What material climate-related risks and opportunities have been identified? How resilient is the organisation’s strategy considering the different climate-related scenarios?

- Risk management – How does the organisation identify and manage climate-related risks?

- Metrics & targets – What metrics and targets are used to assess and manage climate-related risks?

Under the last point, reporting entities should disclose Scope 1, Scope 2, and if relevant Scope 3 GHG emissions.

Additionally, the TCFD defines seven principles for quality disclosure. Disclosed information should be:

- Relevant;

- Specific and complete;

- Clear, balanced, understandable;

- Consistent;

- Comparable across companies in the same industry;

- Reliable, verifiable, and objective;

- Timely.

TNFD

Task Force on Nature-related Financial Disclosures

Like the TCFD, the TNFD is developing a framework to report on nature-related risks.

Once again, the goal is to provide the right information for financial resources to support nature-positive initiatives.

The framework is under development through an open innovation approach that involves science bodies and other relevant stakeholders.

A beta version of the framework is already available since November 2022. The full version ready for market adoption is expected in September 2023.

The disclosure recommendations developed in the latest beta version of the framework adopt the same structure as the TCFD framework. Therefore, reporting entities should disclose:

- Governance – How is management overseeing and assessing nature-related risks and opportunities?

- Strategy – What are the actual and potential impacts of nature-related risks and opportunities on the organisation’s business?

- Risk & impact management – How does the organisation identify and manage nature-related risks and opportunities?

- Metrics & targets – What metrics and targets are used to assess and manage nature-related risks and opportunities?

The TNFD framework is centred on the following principles:

- Market usability – the framework must be easy to adopt for reporting entities and users;

- Science-based – the framework must be rooted in science;

- Nature-related risks – the disclosure should portray nature-related risks constituting a material threat to the reporting entity and overall society;

- Purpose-driven – the framework should direct reporting entities towards the reduction of nature-related risks. Additionally, by increasing transparency in financial markets it should increase nature-positive initiatives;

- Integrated & adaptive – the TNFD aims to develop a standard which is compatible with other existing frameworks;

- Climate-nature nexus – the framework aims to highlight the strong connection between climate and nature-related risks.

- Globally inclusive – the framework must be relevant and applicable worldwide.

SEC

Last March, the US Security and Exchange Commission (SEC) proposed a new rule mandating public companies to improve carbon disclosure.

If adopted, the SEC’s rule would request disclosure of:

- Material climate impacts;

- Generated greenhouse-gas emissions;

- Targets or transition plans.

If the rule comes into force, US large companies will have to report on 2023 data starting in 2024. For smaller companies the rule would apply with one year delay, starting in 2025.

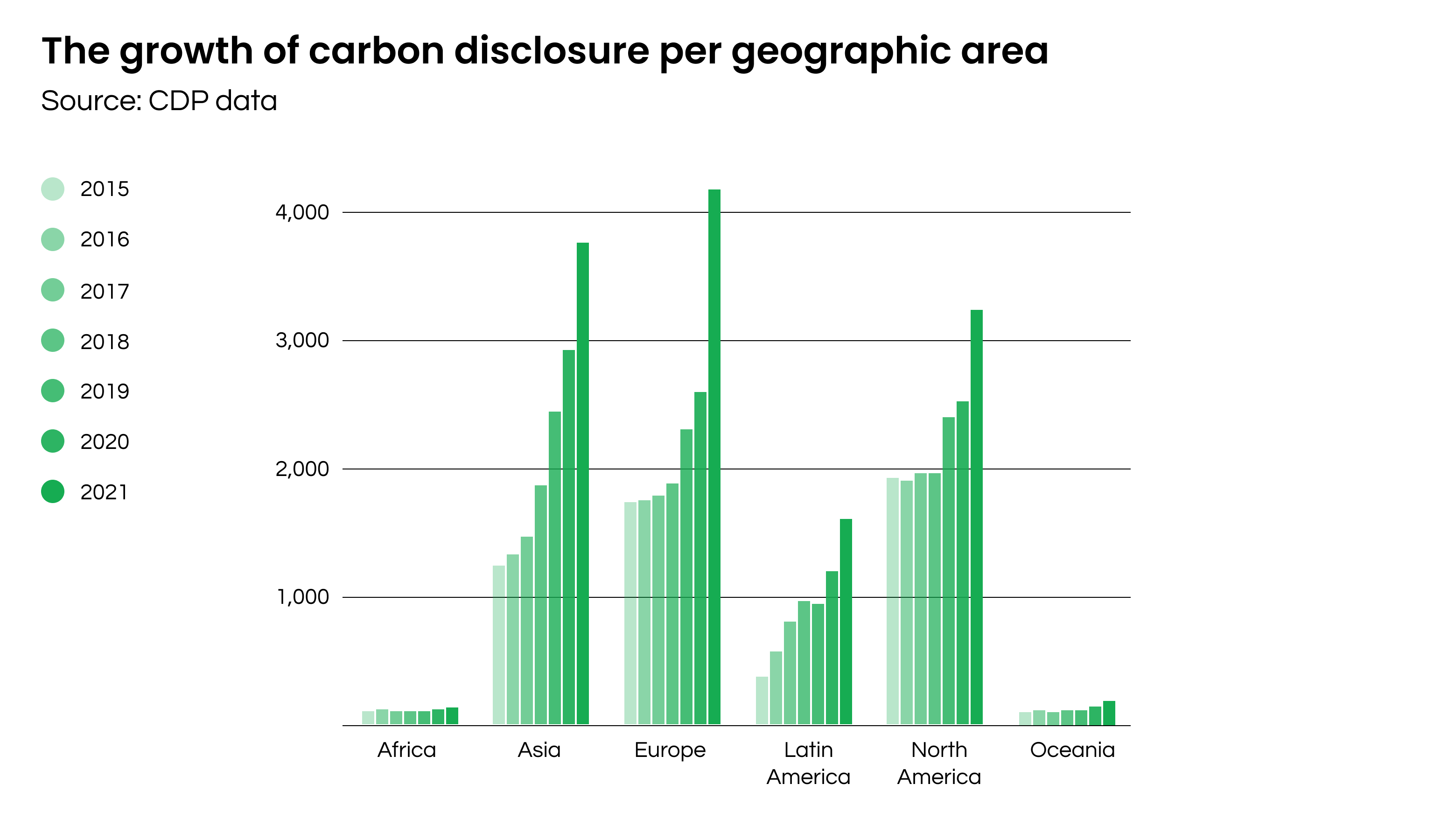

How is carbon disclosure growing?

As we see more and more carbon disclosure standards being developed, climate-related reporting is growing at a rapid pace.

The latest EY Global Climate Risk Barometer identifies an increase in climate disclosure by companies.

The growth in the disclosure can be attributed to the:

- Increasing number of regulators making TCFD reporting mandatory;

- Higher pressure from investors;

- Integration of TCFD recommendations in CDP responses.

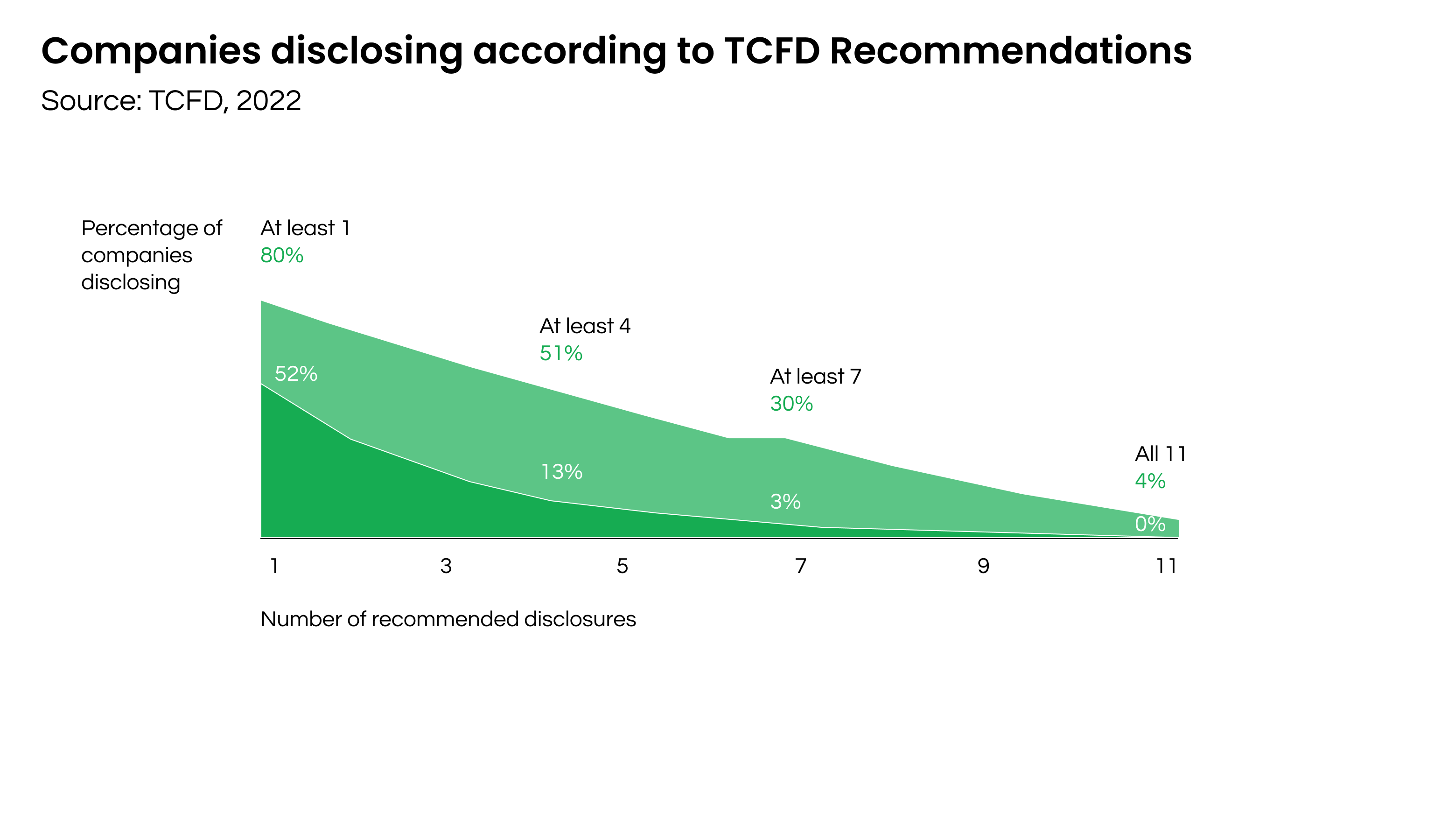

The 2022 TCFD Status Report finds that 80% of companies disclosed in line with the TCFD framework. However, there is still room for improvement concerning the level of detail of the disclosed information.

In fact, out of the 11 recommended disclosures of the TCFD framework, only 4% of surveyed organisations cover all of them.

Why should your organisation report on its climate impacts?

If you're wondering why your organisation should disclose information on climate-related risks, here is a list of the main benefits:

- Improve the company’s reputation – build your stakeholders’ trust by transparently communicating your impacts and the way you manage them.

- Boost competitive advantage – outdistance your competitors by accessing capital with more ease.

- Track and benchmark progress – monitor your performance over time and compare it with the one of your peers.

- Identify risks and opportunities – identify risks promptly and seize opportunities through timely action.

- Plan strategically – improve the evaluation of risks and their magnitude over the short, medium and long term.

- Stay up to date with regulation – make sure your organisation is always on top of the regulatory game.

Is disclosure enough?

Before closing this article, we want to cite some findings highlighted by the fourth EY Global Climate Risk Barometer.

Despite the growth in carbon disclosure, organisations are still lagging in translating their claims into practical strategies.

Additionally, organisations are reluctant to integrate climate reporting with their financial disclosure: only 29% of companies do so.

This can be attributed to a lack of knowledge in understanding climate-related risks across financial teams.

To conclude, carbon disclosure contributes to the decarbonisation process by tracking progress and keeping organisations accountable.

However, on top of that organisations need to:

- Set realistic yet ambitious climate reduction targets;

- Collaborate across the entire value chain;

- Update the strategy based on the different climate scenarios;

- Rethink their products and business models to reduce emissions.