What Is Double Materiality & How Does It Fit In With CSRD Requirements?

Understanding the concept of double materiality and how to apply it within your company has never been more important.

With the EU’s CSRD (Corporate Sustainability Reporting Directive) requirements soon coming into force, double materiality reporting is set to become mandatory for many organisations.

So to get a better understanding of this important concept, here we take an in-depth look at:

- What exactly this concept entails;

- How it fits in with upcoming CSRD requirements;

- A practical example of how to apply it;

- And how embracing the concept can benefit your overall ESG strategy.

First of all, let’s consider what the term double materiality really means.

What Exactly Does Double Materiality Mean?

The double materiality concept has to do with the ESG-related information a company reports. Particularly, it involves expanding the scope of information that is considered ‘material’ or important.

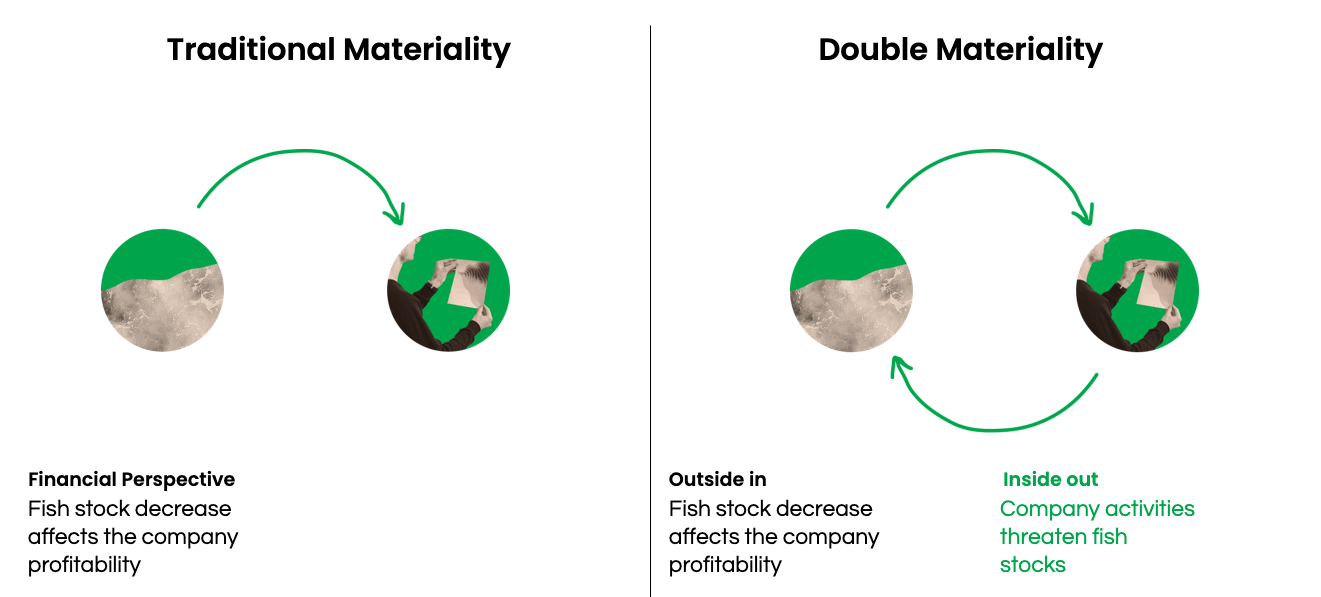

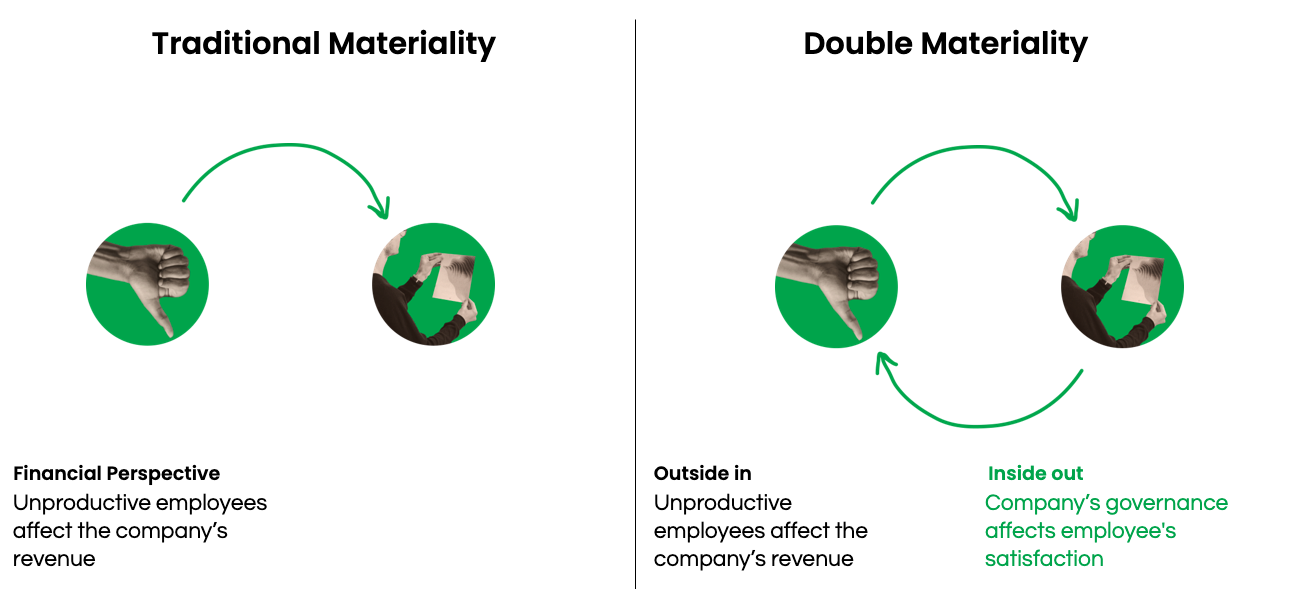

With traditional materiality reporting, information is only considered material if it is related to factors impacting a company’s financial performance. When using double-materiality reporting, information relating to how a company impacts the world is also considered material.

Basically, double-materiality reporting involves reporting on ESG-related matters that affect a company’s well-being and reporting on how the company’s actions affect people and the environment.

Here are a couple of examples that illustrate the difference between traditional and double-materiality reporting.

Example 1: Seafood Company & Overfishing

For a large company that primarily makes revenue from selling seafood globally, data indicating that overfishing and climate change are depleting global fish stocks would be seen as material information for obvious reasons.

Using traditional materiality reporting, this issue would be reported as a potential negative impact on the company’s future revenue opportunities. Using double-materiality reporting though, the company would also likely report on how its own activities are impacting fish stocks by contributing to overfishing and climate change.

In this case, company stakeholders reading the double-materiality report would find out that the company’s own activities are directly leading to an issue that will likely impact its future financial performance. (Showing a link between how a company impacts the world around it, and how that altered world eventually impacts the company; ultimately underlining the importance and relevance of double materiality reporting).

Example 2: Company with Dissatisfied & Unproductive Employees

If a company were to conduct an employee satisfaction survey and the findings suggested that its employees were largely dissatisfied and unmotivated, this would certainly be material information for that company.

Traditionally, an issue like this would be reported for its negative impact on company productivity, and therefore financial performance. Maybe the company might look to replace many of its employees as a result of such a report.

Double materiality reporting however would involve the company also reporting on how its governance and activities toward its employees impact their satisfaction and motivation. This could instead lead to the company altering its governance and making efforts to increase job satisfaction and motivation for its current employees.

These examples offer a good indication as to what double materiality means, but how does the concept relate to the upcoming CSRD requirements?

Double Materiality Is A Key CSRD Requirement

The Corporate Sustainability Reporting Directive, or CSRD, is an EU directive which aims to substantially increase reporting requirements for companies that fall within its scope, so as to expand the sustainability information made available for users.

The directive was announced on April 21st 2021, and the first of the new reporting requirements it entails will become active in 2024.

Double materiality will be a significant part of these new requirements, with the directive requiring companies to report

Not only on information to the extent necessary for an understanding of the undertaking’s development, performance and position but also on information necessary for an understanding of the impact of the undertaking’s activities on environmental, social and employee matters, respect for human rights, anti-corruption and bribery matters.

This means that for any companies affected by the CSRD, double materiality reporting on ESG-related issues will soon become compulsory by law. And the number of affected organisations will likely be high, as the directive is expected to increase the number of companies subject to EU sustainability reporting requirements from roughly 11,700 companies to roughly 49,000.

Specifically, the CSRD will apply to all large EU companies (this includes EU subsidiaries of non-EU parent companies) that exceed at least two of the following criteria:

- 250 employees

- €40 million in turnover

- €20 million in total assets

If your company falls under this umbrella, it’s absolutely essential that you start considering how you might apply double materiality reporting within your organisation as soon as possible.

Of course, how exactly to do this is different for each company, but let’s look at a practical example to give you an idea of how it might work.

How Can You Apply Double Materiality within Your Company?

A Practical Example

One example of how you can apply double materiality within your company is how you report about your energy consumption.

Currently, you might be reporting on the financial cost of the energy your company uses, and how that affects your financial performance. But if you apply double materiality reporting to this situation, you would also want to report on the impact your energy consumption has on the environment and society. This would involve measuring the levels of greenhouse gasses (GHGs) emitted across your company’s value chain each year as a result of energy usage. You might also need to measure and report how your energy consumption contributes to resource usage, water pollution, and the creation of solid waste.

Double materiality reporting would also be useful when assessing the potential benefits of switching to renewable energy. One one side, this would involve reporting on the potential cost savings switching to renewable energy would bring to your company. Simultaneously on the other side, it would involve reporting about the reductions in GHG emissions, and improvements to the environment that making the switch would bring to the world.

Once you have embraced double materiality reporting within your organisation, it can be very beneficial in a number of ways.

What Are The Benefits of Using Double Materiality?

From increasing stakeholder engagement to attracting modern-day investors, there are many ways double materiality can contribute to the long-term success of your business.

Corporate Transparency

When implemented extensively, double materiality reporting will create complete transparency regarding your company’s impact on society and the environment. This can be used to respond to any stakeholder demands for corporate transparency.

Increased Stakeholder Engagement

Speaking of stakeholders, double materiality reporting should involve engaging with different stakeholder groups, and working with them to determine what they consider to be material. This will create a much more holistic view of the challenges and opportunities your organisation faces compared to standard financial reporting.

Eliminate Threats to Your Reputation

Going through the process of implementing double materiality will allow you to identify any negative impacts your company may be having on the world. Left undetected, these impacts can eventually damage your brand’s reputation, so detecting and eliminating them before that happens is essential.

Eliminate Threats to Your Reputation

Using double materiality will also provide your sustainability team with the information needed to effectively prioritise objectives. This will ensure that you are focusing your energy in the right places.

Effective Management Strategy

Double materiality can help you create effective strategies for managing particular issues by providing you with a better understanding of those issues. Using fossil fuel-based vehicles in the supply chain could be an example of this. In this case, it might be that the continued use of fossil fuel-based vehicles poses an immediate risk to your organisation due to upcoming legislation.

Or maybe, switching to fossil-free transport is simply seen as part of the company’s obligation to mitigate related impacts. Double materiality reporting could be used here to determine which of these potential situations is most accurate, helping you to develop the most suitable strategy for managing the issue .

Attract Modern Investors

Consideration of ESG metrics is now standard practice for investors. So increasingly, companies will struggle to attract investment without first providing clear information about their ESG-related impacts. As we’ve already discussed, double materiality reporting is an effective way to provide just that.

In fact, double materiality can be very helpful when it comes to understanding and developing your wider ESG strategy.

Double Materiality & Your ESG Strategy

When implemented effectively, double materiality will not just become a part of your ESG strategy, it should become the driver of it.

Effective double materiality reporting involves conducting a double materiality assessment. Such an assessment will help you thoroughly identify the environmental and social issues that are most relevant for your business and all your stakeholders. These are the issues that should be at the core of your ESG strategy and understanding them from a double materiality perspective will allow you to develop a strategy that optimises your ESG performance.

When the CSRD requirements come into force, double materiality may well become compulsory for your business. But regardless of whether it’s compulsory or not, embracing it just makes sense; for the future of your business, society, and the planet itself.

If you feel you need some help with conducting a double-materiality assessment, or with any aspect of your ESG strategy, don’t hesitate to contact us. We’d be delighted to guide you through any stage of your ESG journey.