The New Corporate Sustainability Reporting Directive

The latest CSRD updates

Last week the European Parliament officially adopted the new CSRD. On the 28th of November, the Council is expected to approve the proposal. After the final vote, the new CSRD will enter the EU Official Journal before coming into force. To make sure you're ready, have a read below.

Non-financial disclosure: a brief introduction

Sustainability disclosure consists of publicly reporting non-financial aspects of a company's performance. These refer to environmental, social, and governance (ESG) topics.

Through non-financial disclosure, organisations communicate to a wide range of stakeholders on:

- Current performance;

- Future ambitions and goals;

- Main risks.

Non-financial disclosure is rapidly becoming part of good business practice mainly due to an increase in regulations and external pressure:

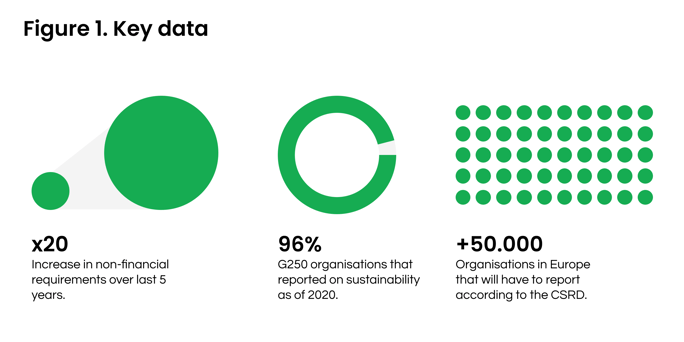

- Non-financial disclosure requirements increased 20-times compared to five years ago;

- 96% of G250 organisations reported on sustainability as of 2020;

- More than 50.000 organisations in Europe will be required to report according to the new CSRD.

However, organisations should not approach non-financial disclosure as a tick-in-the-box exercise, as disclosing their sustainability performance can:

- Foster value creation;

- Improve stakeholder relationships;

- Reduce negative impacts;

- Increase investments;

- Improve brand reputation and boost market competitiveness;

- Enhance talent acquisition and retention;

- Positively influence stock price performance;

- Support the development of a sustainable business model.

What is the new CSRD?

The new CSRD aims to provide more verifiable, accessible and coherent non-financial data. The CSRD will act as the new fundamental sustainability reporting framework. It will be heavily based on the structure of the Global Reporting Initiative (GRI) Standard, within the EU.

The CSRD has been adopted on the 21st of April 2021. It will come into effect in 2024. This means that organisations previously required to report against the NFRD will start reporting in 2025 on 2024 progress. For other applicable companies see the timeline section.

How will organisations comply?

The European Commission and the European Financial Reporting Advisory Group (EFRAG) are developing the new European Union Sustainability Reporting Standards. They will be at the foundation of the CSRD.

Reporting entities will prepare their disclosure in XHTML format to comply with the ESEF regulation and the EU Sustainability Taxonomy.

Who's going to report?

Entities that will fall under the scope of the new CSRD are:

- All companies listed in the EU;

- Large organisations that are either an EU company or a subsidiary of a non-EU Company.

Organisations will be categorised as 'large' entities when meeting at least 2 out of the following 3 criteria:

- Total revenues: more than € 40.000.000

- Balance sheet: more than € 20.000.000

- Number of employees: more than 250

Non-EU-based companies with subsidiaries located in EU countries that match two out of the three previous criteria are recommended to future-proof their entire organisation by disclosing according to the new CSRD with regard to the entire entity.

The Directive does not apply to:

- Listed SMEs with financial assets on growth markets or multilateral trading facilities;

- Non-listed SMEs.

Moreover, the Directive also excludes listed micro-enterprises which meet at least two of the following criteria:

- Net turnover: less than € 700.000

- Total assets: less than € 350.000

- Average of employees: less than/or 10 during the year.

The excluded firms, however, can use the developed standards voluntarily.

What will organisations have to disclose?

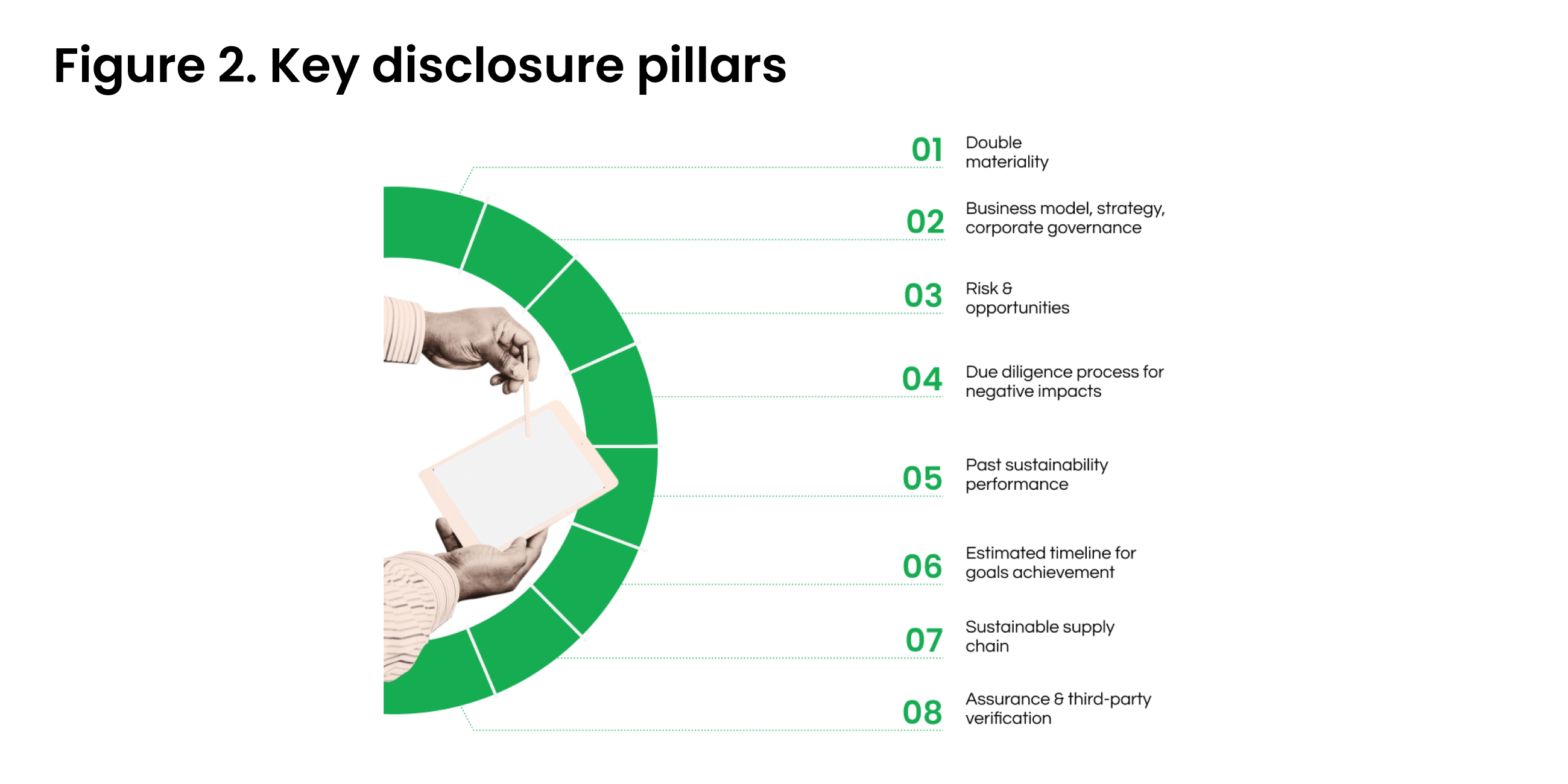

01. Double materiality

Organisations will be requested to provide information concerning their financial and non-financial material (relevant) impacts. Therefore, organisations will have to conduct a materiality assessment, similar to what is already required by the GRI Standards (GRI3).

The European Commission and the European Financial Reporting Advisory Group (EFRAG) are developing the new European Union Sustainability Reporting Standards (ESRS).

As announced by the EFRAG, the new Standard will be heavily based on the Global Reporting Initiative (GRI) Framework.

Therefore, the concept of double materiality will be at the foundation of the new CSRD. Moreover, as the GRI started to develop sector standards, we can expect a similar approach for the new CSRD as well.

02. Business model, strategy, corporate governance

Organisations must report their overall sustainability strategy. Additionally, they have to explain how it is managed across the organisation and highlight the roadmap of their sustainability transition. It is important to draw the connection between the organisation’s sustainability and corporate strategy, as well as who from top management is responsible for executing the sustainability strategy.

03. Risks & Opportunities

Reporting entities will be required to disclose their main sustainability-related risks and opportunities, together with future ambitions and targets. They will have to provide a description of the process to identify impacts, risks, and opportunities.

04. Due diligence process for negative impacts

Due diligence is the process of identifying and mitigating actual and potential negative impacts. Organisations will have to explain:

- How they have conducted their due diligence;

- What risks and negative impacts were identified;

- How these risks have been mitigated throughout the reporting period.

05. Past sustainability performance

Organisations must report their previous sustainability performance by disclosing their KPIs and achieved results.

06. Estimated timeline for goals achievement

Organisations will be requested to communicate on their set of goals and targets to achieve their sustainability objectives.

07. Sustainable supply chain

Reporting entities will be required to extend the coverage of their disclosure to include suppliers and related supplier practices.

The CSRD requirements will trickle down into companies’ supply chains. Suppliers will have to provide additional information to allow reporting companies to report as accurately as possible.

A key requirement will be to measure and report on carbon emissions and provide a complete environmental footprint. To do so, companies will have to request their suppliers to perform carbon footprint assessments. The CSRD thus affects organisations throughout the value chain.

08. Assurance & third-party verification

Non-financial communication published under the CSRD Framework has to undergo an auditing process through a third independent-party verification.

What are the key reporting criteria under the CSRD?

- Relevant - Disclosure must revolve around relevant material topics identified through a materiality assessment.

- Faithful - Disclosure must provide a complete and unbiased representation of the organisation’s performance.

- Comparable - Ability to compare the disclosed information with those of other organisations as well as year over year.

- Verifiable - What has been declared can be verified by explaining the process and information used in the disclosure.

- Understandable - Information should be presented in a clear and synthetic manner.

What is the expected timeline?

How to get ready?

See where you stand

Map your existing reporting system and spot the gaps against the CSRD requirements to identify your priorities.

Apply double materiality

Make sure you are disclosing all the ESG topics you are having an impact on. Likewise, report on those issues that are influencing your business model.

Map your risks

When developing your sustainability strategy, set up a risk management system to promptly act on your material topics.

Track your achievements

Develop targets and KPIs that will allow you to track progress over time and systematically report on that.

Look into auditing

Prepare yourself to undergo an auditing of sustainability information as the new CSRD requests third-party verification.

.png?width=906&height=453&name=Figure%203.%20Expected%20timeline%20(1).png)