The Negative Impacts Of Cryptocurrencies

Cryptocurrency, coins and mining are all terms that have been tossed around in traditional and social media over the past couple of years. Only more recently, however, has this bustling industry been linked with environmental sustainability and climate change. These topics are not normally associated with digitally based services. But if this isn’t the norm, why associate the two now?

Cryptocurrency has been around since the invention of Bitcoin, the first official of such currencies, invented by Satoshi Nakamoto in 2008. The purpose of crypto is to act as a decentralized form of digital currency, accessible to all and regulated by none. To this day these values hold true within the world of crypto that now encompasses more than 4500 mineable coins.

Nonetheless, with scale comes scrutiny. Therefore, investment in cryptocurrency is increasingly being done with the environmental impact in mind. Conflictingly, however, environmental sustainability reform generally requires regulations or law-making of some sort meaning that perhaps these core principles need to be revised after all.

Why is cryptocurrency so bad for the environment?

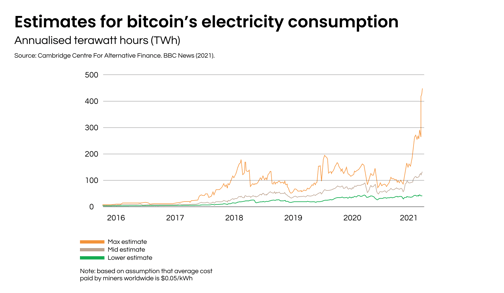

The short answer to this question is relatively simple. Cryptocurrency mining traditionally has a high energy requirement. A significant amount of this energy comes from non-renewable or otherwise polluting energy sources. This energy use is so high that Bitcoin alone uses around half as much energy as the worlds data centers. This is approximately 0.6% (130 TWh) of the global energy usage. According to CNBC, it contributes 35.95 million tons of CO2 every year.

The Ethereum network uses about as much power as the country of Qatar. A 2019 report by CoinShares found 74.1% of the power used in the process of mining came from renewable energy like solar power. Another report from Cambridge Centre for Alternative Finance, however, found this number to be 39%. Regardless of where in this range the real value lies, these currencies undoubtedly use huge amounts of energy. However, as it turns out, it needn’t be so great.

Before continuing it is perhaps appropriate to briefly dive into how crypto mining works. Firstly, one must understand Blockchain technology. This is an incredibly long chain of blocks of transaction information documenting the entire history of a currency.

This is important because this embodies the transparent nature of cryptocurrency. Additionally, miners compete to add transaction information to this chain in exchange for cryptocurrency. So how do miners compete for coins?

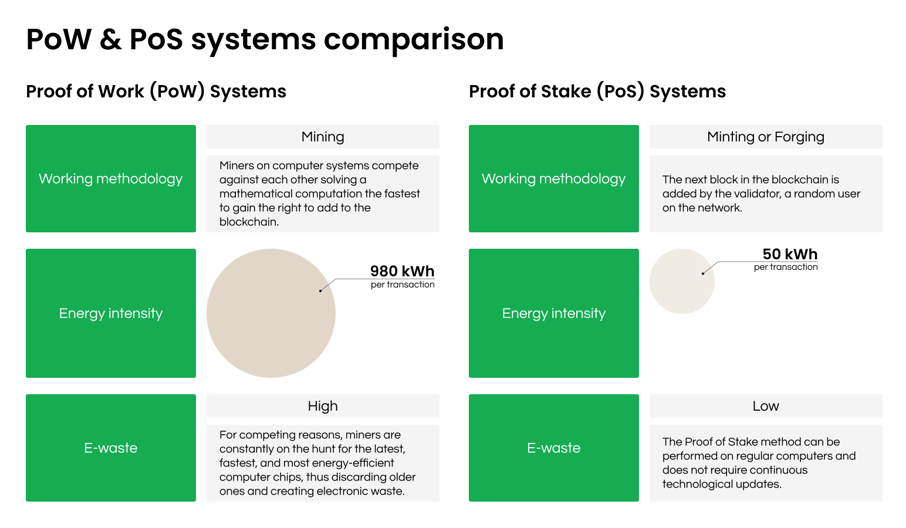

There are two methods of mining that currencies use, ‘Proof of Work’ and ‘Proof of Stake’. Most currencies use the ‘Proof of Work’ (PoW) system. This process works through countless miners or computer systems attempting to solve a mathematical computation the fastest in order to earn the right to add to the blockchain. These calculations take on average around 10 minutes to complete and require very high computing powers.

Furthermore, the more users compete in this digital arms race, the harder the calculations they have to solve become and the more energy is needed to do so. A single Mastercard transaction uses roughly 0.0006 kWh of energy. To put it into perspective, a single bitcoin transaction uses approximately 980 kWh.

Interestingly, the energy use of PoW systems is also affected by market dynamics. As mentioned above the more users competing for coins, the harder the calculations become. When the price crashes or falls drastically, the rate at which new coins are mined decreases.

Miners turn off their equipment since it often isn’t profitable to run them anymore at that point. This notably happened in November 2018 when the energy use of Ethereum more than halved (20 TWh to 10TWh) in under 20 days because the price had crashed.

The other system of adding to the blockchain and obtaining cryptocurrency is called ‘Proof of Stake’ (PoS) and completely removes the element of mining from the equation. In a PoS system a random user on the network, or validator, in this case, is chosen to add the next block to the blockchain. This process is called minting or forging.

These validators are not chosen completely randomly but rather based on the size of a stake that the user enters into the network as a sort of security deposit. Now noteworthy is that a single PoS transaction uses around 50 kWh. A key difference between the two systems is that PoS uses far less energy as users don’t need to solve complex puzzles.

Worth mentioning is also that crypto mining doesn’t just harm the environment through excessive energy use, but also by creating large amounts of e-waste. Quite simply this happens because as hardware is continuously updated and released, any ‘old’ tech becomes obsolete. The equipment necessary for mining is often very difficult to re-use or recycle making it even more wasteful. This wastefulness is especially true for Application-Specific Integrated Circuits (ASIC) as these cannot be reused for any other purpose.

The future of sustainable Crypto

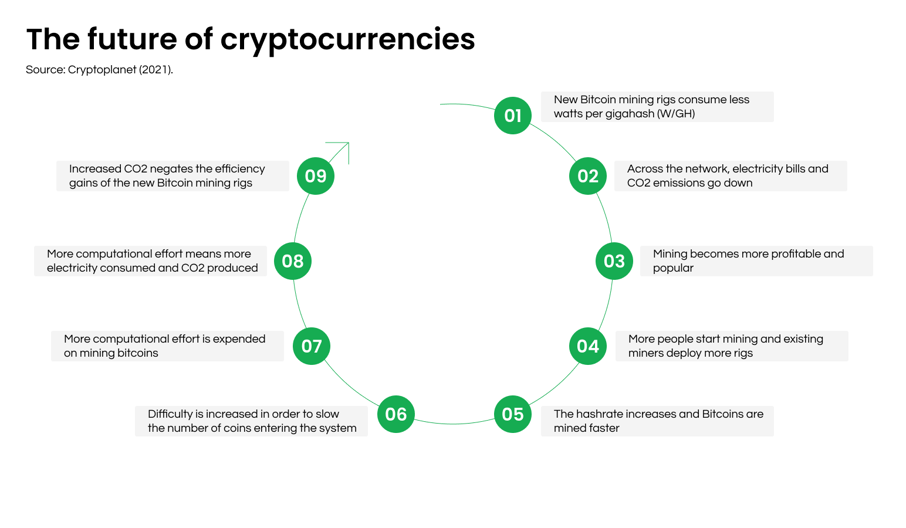

The way most cryptocurrencies currently operate is unlikely to be viable going forward. Put simply, any ‘Proof of Work’ coin is due to fail and for most, it’s only a matter of time. This is because the more of the currency that comes into circulation, the more computing power is required to mine more.

This means there is a finite point in the growth of PoW currencies. Inevitably, we will reach a point at which the cost of the climate and health damages caused by the creation of each new coin outweigh the value of that coin. In 2020 $1 of Bitcoin created roughly $0.49 worth of health and climate damages.

Ultimately, this means new solutions need to be found to produce an eco-friendly cryptocurrency. Luckily there are a few.

Miners currently make approximately 160 quintillion calculations every second, all of which are useless calculations. This high volume of calculations also limits the number of transactions possible in a day to 5 every second. Something that makes the scaling of such a currency impossible past a certain point. The most obvious change in the industry is for currencies to switch from PoW systems to PoS systems.

While there are already a lot of currencies out there that use PoS, some of the major ones with the greatest carbon footprint, such as Bitcoin, are still using PoW. Interestingly, there are even already currencies using something called a Delegated Proof of Stake (DPoS) system which resembles a representative democracy.

In this system, there are 21 servers that are voted on by those with stakes in the currency to become the sole block producers and manage the blockchain. This does make a currency a lot more vulnerable since there is no longer the seemingly infinite number of nodes on which the currency relies.

However, it has also been shown to greatly reduce overall energy use, thus making it more environmentally friendly. Whatever shape the future does take, innovations like these definitely paint a more promising picture of the sustainability of crypto.

Sources and additional reading

Aamoth, D. (2021). Here’s how to fix cryptocurrency’s energy consumption problem

Blinder, M. (2018). Making Cryptocurrency More Environmentally Sustainable

Crypto Climate Accord. (2021). Open-source “Green Hashrate” software solution will track and verify green Bitcoin mining

Cryptoplanet. (2021). The Bitcoin Proof of Work and Difficulty Planetary Death Spiral

Goodkind et al. (2020). Crypto damages: Monetary value estimates of the air pollution and human health impacts of cryptocurrency mining

Huang, R. (2021). CNBC- The Energy Consumption of Bitcoin

Kaplan, E. (2021). Cryptocurrency goes green: Could ‘proof of stake’ offer a solution to energy concerns?

Martynov, O. (2020). Sustainability Analysis of Cryptocurrencies Based on Projected Return on Investment and Environmental Impact

Mathews, L. (2021). The 16 Most Sustainable Cryptocurrencies for 2021

Reiff, N. (2021). What’s the Environmental Impact of Cryptocurrency?

Rowlatt, J. (2021). How Bitcoin’s vast energy use could bust its bubble

TEAL. (2020). Cryptocurrencies and Sustainability

TQ Tezos. (2021). Proof of Work vs. Proof of Stake: The Ecological Footprint

UN News. (2021). Sustainability solution or climate calamity? The dangers and promise of cryptocurrency technology