Sustainability for Businesses: Why you Should Invest in Sustainability in 2024

The Business Case For Doing Your Sustainability Right

While sustainability has been increasingly on the radar of companies in recent years, for many it has historically felt more like a burden than an opportunity. Justifying the importance and relevance of becoming more sustainable was mostly seen as an uphill task, with motivation primarily driven by extrinsic rather than intrinsic forces.

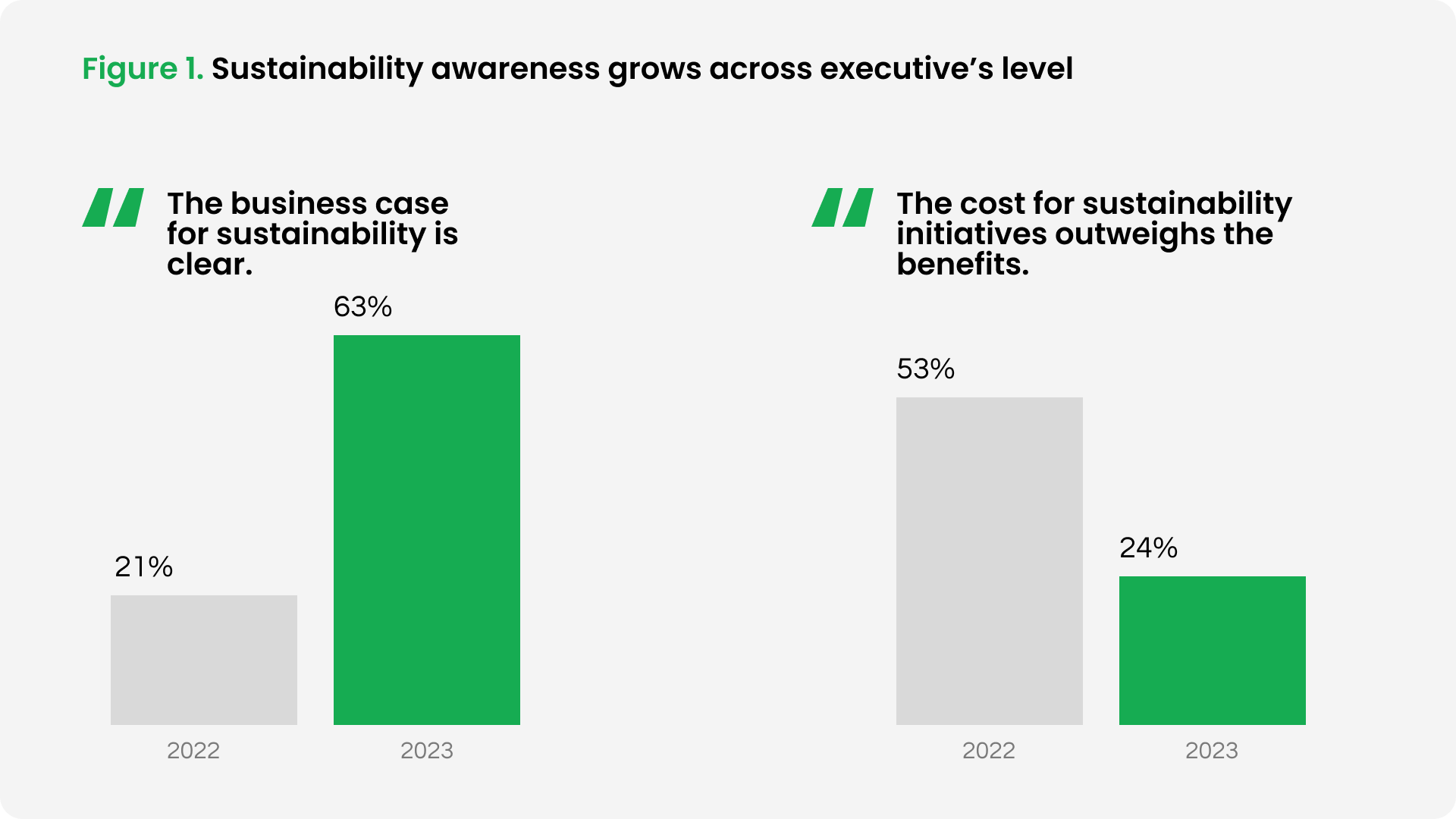

However, as sustainability continues to grow in the consciousness of stakeholders – investors, employees, customers, governments, suppliers and others – it also appears to be gaining clarity and conviction at the top level of companies. A recent study from the Capgemini Institute suggested that the percentage of executives (in a sample size of 2004 across 668 organizations) who agreed with the statement ‘the business case for sustainability is clear’ had tripled from 21% in 2022 to 63% in 2023. Similarly, the figure for ‘the cost for sustainability initiatives outweighs the benefits’ fell from 53% to 24% over the same period.

Despite this welcome mindset shift, for many, it is still difficult to capture this business case. This article aims to highlight some of the key possibilities and, importantly, how this opportunity can be communicated and shared across all levels of companies and society.

Regulatory Push

Led by the European Union, sustainability legislation is rapidly being created and adopted. The most notable is the Corporate Sustainability Reporting Directive (CSRD), for which companies will have to start reporting in 2025. The directive will require approximately 50,000 European companies to publicly disclose their sustainability efforts, with various requirements such as conducting a double materiality assessment, externally assuring sustainability data and requiring reports to be digitally tagged. The driving force behind this is to increase the verifiability, accessibility and coherence of non-financial data across the continent.

Following closely behind is the Corporate Sustainability Due Diligence Directive (CSDDD), which will require companies to go beyond disclosure and identify, monitor and mitigate any potential adverse risks or impacts from their business activities. The directive also mandates companies to address these impacts across their value chains as well as within their own operations. Approximately 13,000 companies, some operating in high-risk sectors such as textiles, agriculture and resource extraction, will be affected.

Additionally, U.S. Securities and Exchange Commission (SEC) is proposing a rule requiring enhanced carbon disclosure for public companies, starting in 2024 for large firms and 2025 for smaller ones.

These regulations, and others which are expected to follow as part of a global regulatory push over the coming decade and beyond, will raise the bar for compliance amongst companies. For example, organisations will be made to report on data points related to their sustainability strategy which will be part of their public disclosures. This means that organisations who already have a history of developing a sustainability strategy are ahead of the curve, and those who have handled sustainability on an ad-hoc basis would have to play catch-up to meet minimum compliance.

Therefore, proactively embracing sustainability and having a comprehensive strategy that moves beyond immediate compliance provides an opportunity for companies to stand out from what is becoming an ever more crowded space. This also helps ensure that your organisation is better positioned for any new, future regulations.

Shifting Stakeholder Landscape

Sustainability is a topic of increasing importance for stakeholders up and down company value chains, with recent studies highlighting several hugely consequential trends and behavioural shifts amongst these groups.

A recent investor survey showed three out of four respondents placing a company’s management of sustainability-related risks and opportunities as a highly important factor in their decision-making, with broad support also shown for capital expenditure that addresses sustainability issues which are relevant to the business even if they resulted in short-term reductions in profitability.

Another showed how 85% of chief investment officers considered environmental, social and governance (ESG) topics as an important factor in their investment decisions, with a significant majority also prepared to pay a premium for companies that show a clear link between sustainability and financial performance. On the flip side, a similar report indicated that 74% of institutional investors were more likely to divest from companies with poor sustainability performance. The risks and opportunities for companies that arise from these trends are clear.

Consumer mindsets are also shifting. This 2023 Sustainable Consumer survey found the following outcomes:

.png?width=906&height=510&name=Figure%202%20-%20Key%20Stats%20(1).png)

Gen Z is a particularly notable demographic within this. Another study showed how the preference amongst this group for sustainable brands increased by 24 percent and their willingness to pay more for sustainable products increased by 42 percent between 2019-21.

Younger generations are also a key group from an employee perspective, particularly around talent attraction and retention. Work from the Antithesis Group indicated that 67% of 16–24-year-olds considered sustainability as an important factor when choosing a company to work for, compared to just 40% for those aged 55 and above.

The ever-increasing presence of sustainability within stakeholder decision-making should give companies significant motivation to capture the opportunities that will emerge from this paradigm shift.

Competitive Edge

Put simply, companies can also benefit from gaining a competitive edge over their industry peers through more mature sustainability strategies. Research from the World Benchmarking Alliance provides the following insight into how its benchmarks have proven to stimulate a sense of competition between companies and encourage a race to the top, providing societal and planetary benefits in the process:

The league tables that are derived from benchmarks leverage the forces of competition to improve corporate performance; leaders are motivated to do more, while laggards are motivated to catch up … For top-performers, the results can be used as a source of competitive advantage while low rankings can act as a

“wake-up call".

This trend can also be factored into customer-supplier relationships; for instance, many larger companies have now set ambitious net zero targets and therefore require the collaboration of their supply chain to measure and reduce their scope 3 greenhouse gas emissions. Suppliers which can readily provide this data and demonstrate action plans for reduction can therefore be seen as more attractive partners of choice.

Similarly, many companies are now further incentivising their procurement activities via specific incentives or preferred supplier schemes linked to sustainability performance, further providing opportunities for suppliers who are already operating more sustainably.

Financial Opportunities

Finally, the business case for sustainability can be made from a simple financial perspective. Evidence is growing on how sustainable companies not only contribute towards a more equitable society while striving to operate within the planetary boundaries but also provide better returns and financial opportunities to impacted stakeholders.

For instance, Accenture’s research on responsible leadership shows how companies with high ratings for sustainability performance enjoyed average operating margins 3.7 times higher than those of lower performers. Furthermore, these companies also received higher annual total returns to shareholders, outpacing poorer sustainability performers by 2.6 times. On the financing side, banks, lenders, credit agencies and other similar bodies are also utilizing sustainability in their client relationships. ABN AMRO, for instance, offers a range of sustainability-linked, aiming to incentivise the achievement of specific performance objectives and green loans, the latter used to finance projects with excellent environmental credentials.

Concerning operational efficiencies, Bain provides insights on how design-to-x approaches (when sustainability becomes the x factor) can allow companies to both reduce costs and improve the sustainability of their products simultaneously. Similarly, EY highlights falling green energy prices and low-carbon technology advances as key facilitators. Using the example of solar panels, they demonstrate how the cost of solar energy in 2020 was less than half of that predicted by the International Energy Agency in 2011. As they state, “This illustrates how, once technologies have been developed, they can be rapidly refined and reduced in cost … Once this happens, momentum builds fast … [these trends] making business cases that looked impossible just a few years ago.”

Additionally, there now exists exclusive equity funds by asset managers who only invest in companies with clear sustainability objectives and impact - eg. Blackrock, Aegon, robeco etc due to SFDR regulations.

Similarly, significant efforts have also been placed recently on quantifying the impact of sustainable interventions, with organisations such as the Value Balancing Alliance, Impact Management Platform and Capitals Coalition at the forefront. Collectively these organisations (and others) are seeking to redefine value creation for companies and consider natural, human and social capital alongside the traditional financial element. Any company which consciously chooses to integrate these considerations into its strategy and decision-making will again be able to differentiate from the crowd in relation to sustainability.

Conclusion

As shown above, stakeholders who are looking to drive home a business case for sustainability can address this from multiple avenues. Broadly, the direction of travel for sustainability is highly likely to continue upwards, therefore, companies who are seeking to capture the opportunities this presents must be committed to allocating the necessary capital, resources, and motivation to do so. While it might be tempting to keep up with sustainability trends by throwing around random data, it's riskier business-wise due to increasing attention from regulations – this is known as greenwashing. Our clear advice is this: when you invest in sustainability, you're committing to doing things right. It's not just about thriving now, but making sure your business stays strong and ready for the challenges ahead.

For starters, companies should consider:

Ensuring full compliance

Starting with a focus on full compliance with regulations provides an opportunity to strengthen sustainability strategy and governance.

Peer benchmarking

By analysing your efforts against industry peers and competitors, companies can begin to determine their standing and prioritise areas where there are opportunities to demonstrate leading capabilities to the market.

Value chain collaboration

Sustainability is best addressed through partnerships and collaboration. Identifying and working closely with like-minded partners will allow companies to rapidly scale the impact and scale of their sustainability interventions and ultimately benefit all parties and their impacted stakeholders.

Seek solutions that bring both financial and sustainability benefits

The business case for sustainability can most tangibly be made by bringing these two factors together. Identifying operational cost efficiencies linked to sustainability and also external investor/capital opportunities that can be accessed via more mature sustainability strategies can enable this to be tackled from two directions.

If you would like to learn more about setting up a future-proof sustainability strategy and practices for compliance, you can book a free initial consultation with our experts below.